- Hashed Out

- Posts

- NFT 101: The Case Studies

NFT 101: The Case Studies

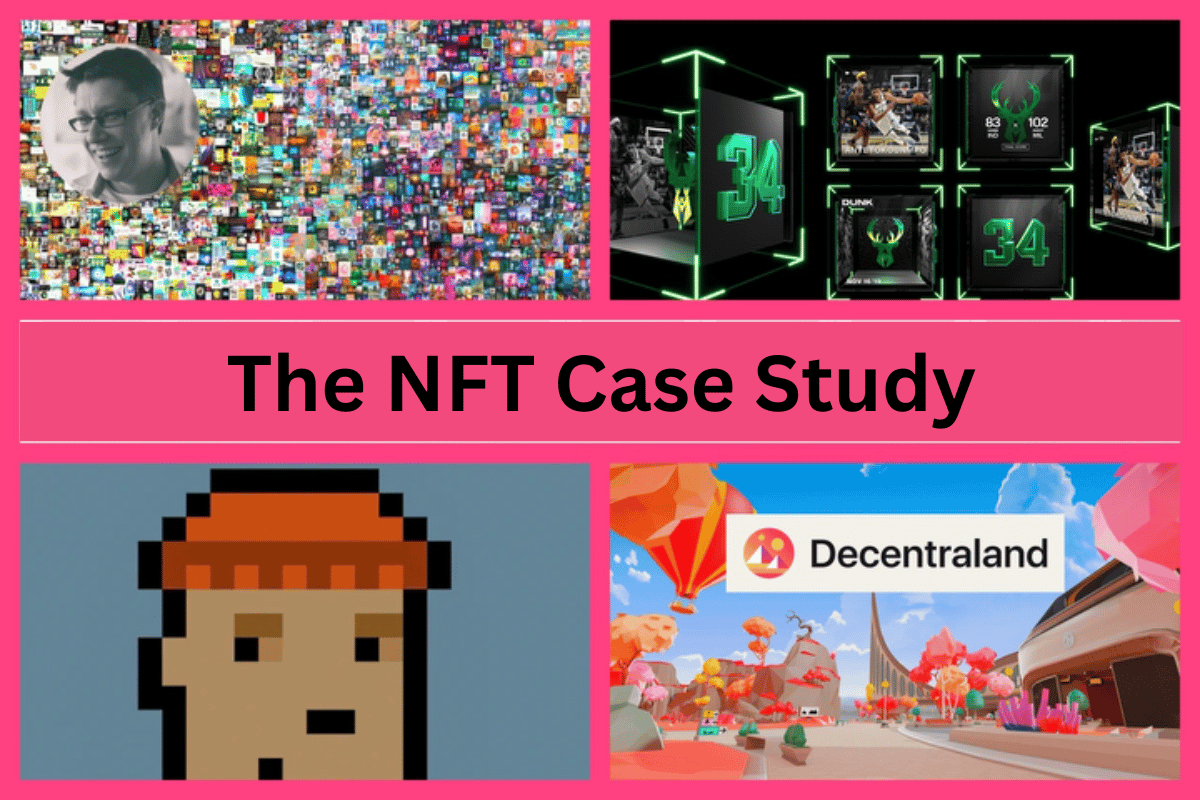

This week in our case study we are featuring four different NFT success stories that capture the different approaches taken in the NFT art and entertainment sector.

Case Study 1: Beeple's "Everydays: The First 5000 Days"

Overview: In March 2021, Beeple, a digital artist known for his provocative and futuristic artwork, made headlines with the sale of his piece "Everydays: The First 5000 Days." This NFT, which is a digital collage of 5,000 individual artworks created daily over 13 years, sold for an unprecedented $69.3 million at Christie's auction house.

Significance: Beeple's sale marked a pivotal moment in the art world, showcasing the immense value that digital art can achieve through NFTs. The sale demonstrated how NFTs can provide a new revenue stream for artists, bypassing traditional gallery systems and directly connecting creators with global collectors. Beeple’s success highlights NFTs' ability to transform perceptions of digital art, giving it the same legitimacy and financial potential as traditional art forms.

Impact on the Art World: Before this sale, digital art was often undervalued compared to physical art. Beeple’s auction challenged this notion by proving that digital works, when authenticated and verified as unique through NFTs, can command significant prices. The sale also prompted a surge in interest from both artists and collectors, leading to increased experimentation and investment in the NFT art market.

Challenges and Considerations: Despite the excitement, the sale also sparked debates about the environmental impact of NFTs, as the blockchain transactions associated with the auction were energy-intensive. Additionally, the speculative nature of NFT markets raised concerns about the sustainability and future value of such high-priced digital assets.

Takeaway: Beeple's "Everydays: The First 5000 Days" represents a landmark moment in the NFT space, bridging the gap between traditional art markets and digital innovation. It underscores NFTs' potential to revolutionize how digital art is created, sold, and valued, paving the way for future artists to explore new revenue models and audiences.

Case Study 2: Decentraland

Overview: Decentraland is a decentralized virtual reality platform built on the Ethereum blockchain, where users can buy, sell, and develop virtual land parcels (LAND) as NFTs. Launched in 2017, Decentraland has evolved into a thriving digital economy where users can create immersive experiences, monetize virtual real estate, and participate in decentralized governance.

Significance: Decentraland exemplifies how NFTs can enable ownership and governance in virtual spaces. Each LAND NFT represents a unique parcel of virtual real estate, providing users with the autonomy to build, trade, and monetize their virtual properties. This model showcases NFTs' potential to create new forms of value and economic activity in virtual worlds.

Impact on Virtual Real Estate: The platform has attracted a diverse range of users, from casual players to major brands and investors. Virtual land sales and developments have led to the creation of virtual galleries, gaming experiences, and branded spaces, illustrating the growing demand for digital real estate. Decentraland also features a decentralized autonomous organization (DAO) that allows LAND owners to participate in governance decisions, demonstrating a new form of community-driven project management.

Challenges and Considerations: Despite its success, Decentraland faces challenges such as scalability issues and the need for widespread adoption to maintain a vibrant virtual economy. Additionally, the speculative nature of virtual real estate investments can pose risks for users, particularly as the market continues to evolve.

Takeaway: Decentraland highlights the transformative potential of NFTs in creating and managing virtual worlds. By enabling true ownership and governance in digital spaces, it offers a glimpse into the future of virtual economies and the role NFTs may play in shaping digital experiences.

Case Study 3: NBA Top Shot

Overview: NBA Top Shot, developed by Dapper Labs, is a platform where basketball fans can buy, sell, and trade officially licensed NBA video highlights as NFTs. Launched in October 2020, NBA Top Shot allows users to collect moments from games, such as dunks, assists, and game-winning shots, each represented as a unique NFT.

Significance: NBA Top Shot represents a successful integration of NFTs into the sports industry, offering fans a new way to engage with their favorite moments and players. The platform combines the excitement of sports collectibles with the technological advantages of NFTs, such as verified ownership and scarcity. This approach has attracted a large and diverse user base, from casual fans to serious collectors.

Impact on Sports Collectibles: The platform has revolutionized the sports collectible market by providing a digital alternative to physical trading cards. NBA Top Shot has created a secondary market where users can trade moments based on rarity, player performance, and historical significance. This model has not only expanded the reach of sports collectibles but also demonstrated the potential for NFTs to create engaging and interactive fan experiences.

Challenges and Considerations: While NBA Top Shot has enjoyed significant success, it faces challenges such as maintaining user engagement and addressing the speculative nature of the market. Additionally, the platform must navigate the complexities of sports licensing and intellectual property rights.

Takeaway: NBA Top Shot exemplifies the innovative potential of NFTs in transforming sports collectibles and fan engagement. By leveraging blockchain technology to offer unique, verifiable digital moments, the platform has set a precedent for how NFTs can enhance and democratize access to sports content.

Case Study 4: CryptoPunks

Overview: CryptoPunks, created by Larva Labs in 2017, is one of the earliest and most iconic NFT projects. The collection consists of 10,000 unique 24x24 pixel art characters, each with distinct traits and attributes. These characters are stored as NFTs on the Ethereum blockchain, and their rarity and uniqueness have made them highly sought after.

Significance: CryptoPunks played a pioneering role in the NFT space, introducing the concept of algorithmically generated collectibles on the blockchain. The project laid the groundwork for future NFT endeavors and demonstrated the potential for digital scarcity and value through unique, verifiable assets. CryptoPunks have become cultural icons in the NFT community, symbolizing the early days of blockchain-based collectibles.

Impact on NFT Collectibles: The success of CryptoPunks has influenced countless other NFT projects and established a precedent for collectible digital assets. The project’s model of generating rarity and uniqueness through algorithmic means has been adopted and expanded upon by various other NFT creators, contributing to the growth and diversification of the NFT market.

Challenges and Considerations: Despite its success, CryptoPunks has faced challenges such as market speculation and volatility. The high value of certain CryptoPunks has also raised questions about the sustainability of such speculative investments in the long term.

Takeaway: CryptoPunks represents a seminal moment in the NFT space, demonstrating how digital assets can achieve cultural and financial significance through uniqueness and blockchain technology. The project's influence continues to shape the NFT landscape, highlighting the potential for creativity and innovation in digital collectibles.

Like What You Are Reading? Subscribe to Hashed Out!

Already Subscribed? Forward This To A Friend!

Other Articles In This Issue:

Visit the Hashed Out Archives For Previous Hashed Out Topics

*Hashed Out is a subsidiary of Argot, a web3 brand strategy and business development agency.