- Hashed Out

- Posts

- How People Actually Lose Money in Web3

How People Actually Lose Money in Web3

The five most common loss patterns — explained simply.

Spend enough time around Web3 conversations and you’ll hear dramatic language: hacks, exploits, collapses, theft. It can all feel unsettling, especially for readers used to traditional banking systems where mistakes are often reversible and institutions act as safety nets.

But here’s the important clarification:

Most Web3 losses don’t come from sophisticated cyberattacks.

They come from ordinary human mistakes.

This isn’t unique to crypto. It’s a pattern repeated across the entire digital world — from email scams to online banking fraud to identity theft. Web3 simply changes one critical variable:

👉 You are often the final authority.

That sounds intimidating at first. In practice, it’s much more manageable than it appears.

Let’s look at what actually goes wrong.

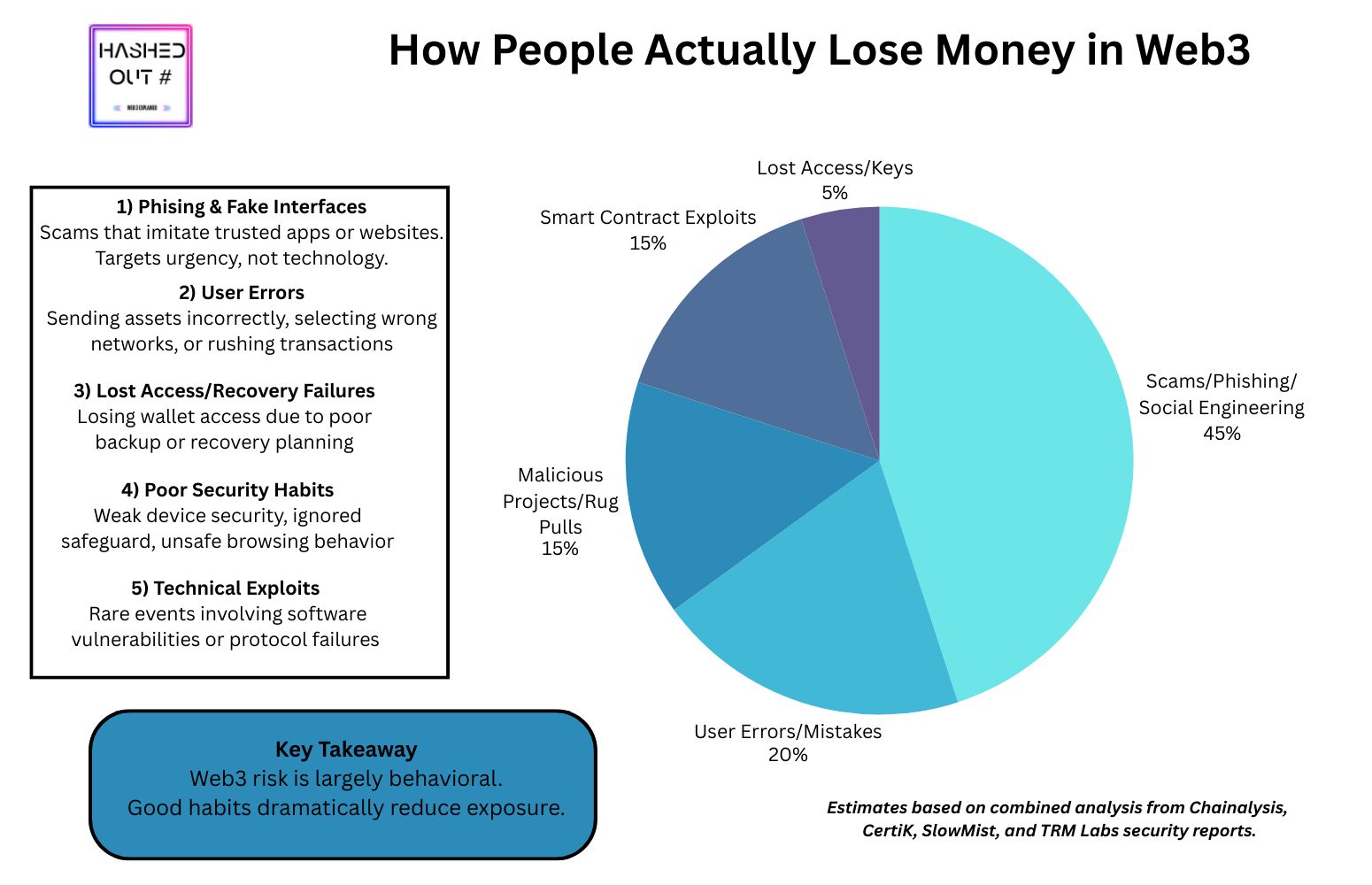

How People Lose Money in Web3 Chart

The Biggest Misconception

When people imagine losing money in Web3, they often picture shadowy hackers cracking encryption or blockchains mysteriously failing.

In reality:

• Blockchains are extremely secure

• Cryptography is extraordinarily robust

• Random “wallet hacks” are rare

• Protocol failures are uncommon

Losses overwhelmingly follow predictable behavioral patterns.

Key Web3 Security Terms

Loss Pattern #1: Sending Assets to the Wrong Address

This is the Web3 equivalent of mistyping an email — except without a recall button.

Why it happens:

• Copy/paste mistakes

• Wrong network confusion

• Rushing transactions

• Address mix-ups

Why it’s preventable:

• Wallet confirmation screens

• Address checks

• Sending small test amounts

• Slowing down

Web3 transactions are precise. Precision rewards patience.

Loss Pattern #2: Phishing & Fake Interfaces

This is the single most common cause of loss — and it’s not a Web3 invention.

Phishing attacks work because they target psychology, not technology.

Why it happens:

• Looks like a trusted site

• Exploits urgency

• Exploits familiarity

• Exploits fear

Key perspective for Hashed Out readers:

If you’ve ever seen a fake bank email, you already understand this risk.

Why it’s preventable:

• Bookmarking important sites

• Avoiding panic clicks

• Verifying URLs

• Skepticism toward urgency

Most digital scams succeed because humans are busy, not because systems are weak.

Common Web3 Scam Tactics

Loss Pattern #3: Custody Confusion

One of the most misunderstood aspects of Web3:

👉 Where are your assets actually stored?

Common misunderstandings:

• Exchange account ≠ personal wallet

• Platform login ≠ ownership

• App interface ≠ custody

Why this matters:

If assets live on an exchange → platform controls access

If assets live in your wallet → you control access

Neither model is “wrong.” But misunderstanding the difference creates unnecessary anxiety.

Loss Pattern #4: Poor Recovery Practices

Early Web3 required users to manage seed phrases manually — a major source of fear.

2025 and beyond have changed this dramatically.

Why losses happened historically:

• Lost seed phrases

• Bad backups

• Unsafe storage

• Device loss

Why this is improving rapidly:

• Smart wallets

• Passkeys

• Social recovery

• Multi-device recovery

• Biometric protection

Modern wallets increasingly resemble traditional apps with strong recovery systems.

Loss Pattern #5: Emotional Decision-Making

Perhaps the most important pattern — and the least discussed.

Most financial losses, in Web3 or elsewhere, are psychological.

Why it happens:

• Fear of missing out

• Panic selling

• Chasing hype

• Following noise

• Acting under urgency

Important truth:

Technology rarely causes major losses.

Human emotion often does.

What Rarely Causes Losses (Despite the Headlines)

Let’s normalize perception.

Rare events:

• Blockchains “breaking”

• Cryptography failing

• Random wallet compromises

• Technical exploits targeting individuals

• Systemic collapse

Most users will never encounter these scenarios.

The dominant risks are behavioral, not structural.

Why Web3 Feels Different

Traditional finance buffers mistakes:

• Chargebacks

• Fraud reversals

• Password resets

• Institutional mediation

Web3 shifts responsibility:

• Ownership → user

• Control → user

• Verification → user

This is not instability.

This is disintermediation.

The Stability Story (Often Ignored)

While risks are widely discussed, improvements are less visible.

2025 Web3 environment:

• Wallet UX dramatically improved

• Recovery systems far safer

• Fraud detection tools better

• Institutional custody mature

• Stablecoin rails stable

• Consumer protections expanding

Web3 is becoming less experimental and more infrastructural.

The Core Takeaway

Web3 risk is best understood as:

👉 Digital literacy risk

The same patterns that protect you online protect you in Web3:

• Slow down

• Verify

• Avoid urgency

• Understand where things are stored

• Use modern tools

• Ignore emotional pressure

Final Thought

Web3 doesn’t introduce entirely new dangers.

It introduces a different balance between:

Convenience ↔ Control

Protection ↔ Responsibility

Intermediaries ↔ Ownership

For many users, that shift ultimately results in greater security, not less — once the patterns are understood.

Stay ahead of the curve with the latest in Web3 culture and innovation. Subscribe to Hashed Out for exclusive insights, case studies, and deep dives into the decentralized future.

Help Grow Hashed Out And Get Rewarded With Premium Content & Merchandise

If you believe in a more open, fair internet — help us build it, one reader at a time.

Web3 adoption starts with curiosity. Share Hashed Out with someone who’s ready to explore.

You’re not just sharing a newsletter — you’re inviting someone into the future of digital life.

Refer 3 friends and unlock premium content. The more you share the more rewards you unlock, including Hashed Out mugs or tote bags, and exclusive community memberships.